New Delhi, India – India’s fitness technology sector has seen a sharp decline in funding, attracting only $7 million in the year-to-date period of 2025. This figure, as per Tracxn’s India Fitness Tech Wrap Report 2025, signals a significant post-boom slowdown in investor activity, reflecting a cautious stance after a peak in 2021.

The current funding landscape marks a notable contraction from the sector’s record high of $387.9 million in 2021.

A Look at the Declining Trend

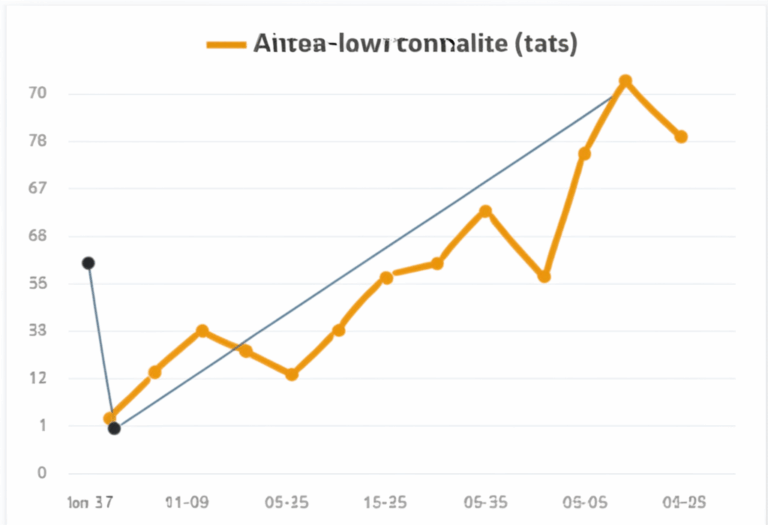

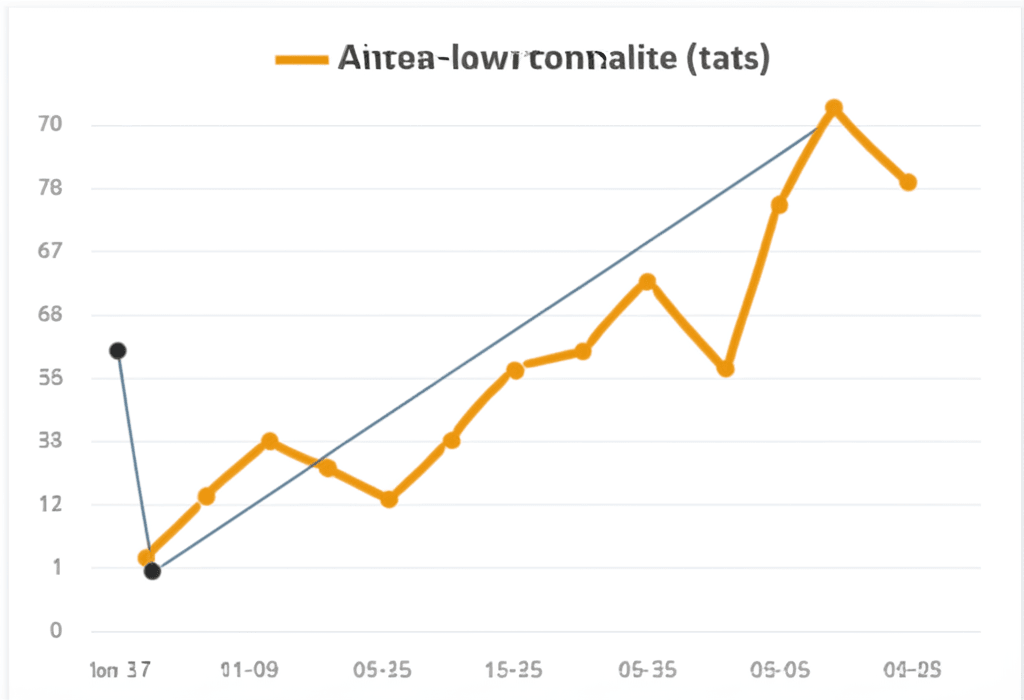

The slowdown in fitness tech funding is not an isolated event but part of a larger “funding winter” impacting the broader Indian startup ecosystem. Annual funding for fitness tech grew from $24.2 million in 2016 to its peak in 2021, before moderating to $48.3 million in 2024. Overall, India’s fitness tech sector has secured $989 million across 203 equity rounds to date.

The country’s entire startup ecosystem experienced a challenging 2023, with funding plummeting to a five-year low of $7 billion, a 73% drop from $25 billion in 2022. This indicates a shift in investor sentiment, moving from aggressive growth-at-all-costs strategies to a more measured approach focusing on profitability and sustainable business models.

Key Players and Funding Hubs

Despite the overall dip, the sector boasts over 600 active startups, with 96 having successfully secured equity funding. Bengaluru continues to dominate as the primary funding hub for fitness tech in India, having attracted $897.6 million in total funding to date, largely driven by major players like Cult.fit and HealthifyMe.

Top Funded Fitness Tech Startups

Cult.fit remains the most heavily funded startup in the Indian fitness tech space, accumulating $666.6 million. Other significant players include HealthifyMe, which has raised $145.3 million for its AI-driven nutrition and fitness coaching, and Ultrahuman, with $54.9 million for its biomarker-led health platform. FITTR also secured $3 million in a Series A round from Rainmatter in 2025 YTD.

Active Investors in the Sector

Leading venture capital firms that have actively backed India’s fitness tech sector include Chiratae Ventures, Blume Ventures, and Kalaari Capital. These investors have participated in multiple funding rounds, supporting the development of the ecosystem.

Reasons Behind the Funding Slowdown

Several factors contribute to the current cautious investment climate in India’s fitness tech sector:

- Global Macroeconomic Headwinds: Rising global interest rates have made capital more expensive and investors more risk-averse.

- Valuation Correction: The pandemic era saw inflated valuations for many startups, and investors are now seeking more realistic and profitable ventures.

- Focus on Profitability: Investors are prioritizing companies with clear paths to profitability and sustainable unit economics over rapid, unsustainable growth. Many startups that burned cash unsustainably are now struggling to secure further funding.

- Reduced Large Deals: The funding landscape is seeing fewer large deals, with a trend towards smaller, early to mid-stage investments. This is partly due to some global investors becoming less active after the funding surge of 2020 and 2021.

Neha Singh, Co-Founder of Tracxn, notes that “India’s Fitness Tech ecosystem is entering a phase of steady maturity, shaped by a combination of rising health awareness, supportive policy initiatives and rapid digital adoption.” She adds that investors still “continue to see strong long-term potential here, even as funding in recent years has been more measured.”

Future Outlook for India’s Fitness Market

Despite the current funding challenges in the tech segment, the broader Indian fitness and wellness market shows robust growth potential. The overall fitness market is projected to more than double in size by 2030, with revenues expected to grow from INR 16,200 crore (approximately $1.9 billion) in 2024 to INR 37,700 crore (approximately $4.5 billion). This represents a compound annual growth rate (CAGR) of 15%.

Factors driving this growth include increasing health awareness, rapid technological innovation, changing consumer attitudes, and rising disposable incomes. The fitness tracker market specifically is also expected to exhibit strong growth, with a projected CAGR of 19.8% from 2025 to 2030, reaching a revenue of $7,656.1 million by 2030.

This indicates that while investors are being more discerning with fitness tech funding, the underlying demand for fitness and wellness solutions in India remains strong, suggesting a maturation of the market where viable, profitable businesses will continue to thrive.